Query

Please provide an overview of evidence on the links between grand and transnational corruption and international efforts to tackle climate change, with a focus on energy transition, biodiversity loss and climate finance.

Introduction

Interest groups may attempt to affect international efforts to tackle climate change for various reasons, including political, ideological, economic and others. In this process, different strategies may be used by these groups, corruption being one of them. This paper focuses on how grand corruption undermines international efforts to tackle climate change. In doing so, the paper focuses on three broad themes to provide an overview of the existing evidence on grand corruption risks:

- energy transition, including decarbonisation policies, renewable energy and critical minerals

- biodiversity loss

- climate finance

Grand corruption

There is not one universally accepted definition of grand corruption. A recent U4 Helpdesk Answer provides a detailed discussion exploring various definitions of grand corruption.

While different definitions of grand corruption have been developed over the years, they typically share three common features: a) misuse or abuse of high-level power by distorting the central functions of government, b) large-scale and/or large sums of money involved and c) transnational component, as grand corruption may cross borders in order to siphon off state resources for private gain (Duri 2020:4-5).

Despite the existence of many different definitions of grand corruption, the central point is that grand corruption involves the capturing of public goods or services at the top political levels. Under ideal conditions, these resources would have been better distributed and led to more socially oriented outcomes.

For the purpose of this answer, grand corruption is defined as a deviation from ethical universalism, a context in which rules apply equally to everyone regardless of religion, identity, political affiliation or other ties. Instead, grand corruption results in “an allocation of public resources which is partial and unfair, due to the presence of ties of a personal and particular nature between office holders and certain individuals or groups” (Mungiu-Pippidi 2017:1).

This definition of grand corruption (Mungiu-Pippidi 2017) is chosen as the most appropriate for this Helpdesk Answer for two main reasons. First, it contains one of the central characteristics of grand corruption typically present across different definitions: that grand corruption involves the abuse of high-level political power to redirect resources and influence rule-making processes towards narrow interests at the expense of public interest. Second, this definition acknowledges the networked nature of grand corruption, as it emphasises the ties between politics and business, and in this way portrays grand corruption as a collective action phenomenon involving multiple actors (Persson et al. 2013).

Within this broadly defined phenomenon of grand corruption, the paper zooms in to its specific manifestations by focusing on the following forms:

- State capture: efforts of powerful individuals, firms, or groups to influence the formation of rules, laws and regulations to benefit their own private interests at the expense of public interest (see Transparency International 2009; National Resource Governance Institute, no date).

- Regulatory capture: cases “where the regulations and regulators for an industry are rendered subordinate to the interests of the industry, with the consequence that regulation is designed and operated primarily for the benefit of the industry” (Philp 2001).

- Institutionalised grand corruption in public contracting: the bending of rules and principles of good public procurement, to benefit the interests of a closed network while denying access to others (Fazekas and Tóth 2016). A subtle difference compared to state capture is that, while the former refers to efforts to influence the formation of laws, rules and regulations, the latter refers to influencing their implementation. The concept has a clear application for climate change policies, as there is broad evidence documenting these practices in relation to climate finance, subsidies, incentives for renewable energy transition and others.

Two other considerations relate to lobbying and the transnational nature of corruption affecting climate action.

Lobbying and other grey areas

While lobbying, defined as “any activity carried out to influence a government or institution’s policies and decisions in favour of a specific cause or outcome” (Transparency International, 2020) is an essential part of a democratic process, challenges can arise in situations characterised by unequal access to decision makers and the promotion of corporate interests over the interest of the public (Mullard 2021; Nest and Mullard 2021).

While, depending on the jurisdiction, these practices may not be illegal, they can constitute an integrity issue and deserve attention as disproportionate influence of corporate groups may be translated into policies that favour narrow benefits over public interest (Jenkins and Mulcahy 2018; Mullard 2021).

- Transnational component of grand corruption. Considering that energy markets and climate finance instruments are embedded in the international financial system, some forms of grand corruption related to climate change policies have a transnational character, which will be addressed in the paper. For example, in the case of state capture, if it is foreign actors (e.g. multinational firms) that try to exert undue influence on policymaking processes in a particular country, this means that state capture has a transnational aspect, and these cases will be discussed under the section on transnational component.

- An additional nuance within the transnational component will be introduced with regards to illicit financial flows related to corruption,which, in this paper, are defined as “when the economic returns from these acts, directly or indirectly, generate cross-border flows and when financial assets are transferred across borders to commit these crimes” (UNODC 2020:14).

Any analysis on the relationship between grand corruption and international efforts to curb climate change has to be mindful of contextual factors, such as institutional quality, levels of democracy, the position of a country in the global division of labour, levels of economic development, and others.

Case study evidence presented in this paper introduces the key contextual factors as these may intervene and shape the way that grand corruption influences climate change policies. However, due to the nature of the paper, contextual factors are not analysed in great detail as the primary focus is on outlining evidence demonstrating how grand corruption undermines international efforts to curb climate change.

As the paper will discuss, there is a broad range of negative consequences of grand corruption on international efforts to curb climate change. As covered in more detail below, these can include:

- environmental degradation

- negative health consequences

- suboptimal allocation of resources

- delays in green transition

- human rights violations

Petty forms of corruption

Petty forms of corruption, such as bribery and embezzlement, may be vertically integrated into more complex forms of grand corruption. As the focus of this Helpdesk Answer is on grand corruption, petty corruption is mentioned only when it is inextricably linked to wider schemes such as state capture.

This Helpdesk Answer is structured as follows. It has three main themes:

- grand corruption in energy transition, with sub-themes on decarbonisation, renewables, and critical minerals,

- grand corruption in biodiversity loss,

- grand corruption in climate finance.

Each theme consists of an introduction about general corruption risks relevant for the theme in question and continues with a discussion on specific manifestations and mechanisms of grand corruption (state capture, regulatory capture, and institutionalised grand corruption), lobbying and other grey areas, and the transnational component of grand corruption and lobbying. Each theme/sub-theme concludes with a discussion on the key negative consequences of grand corruption in climate change policies.

The Annex provides a summary of the key findings by outlining the key forms of grand corruption identified, key actors, manifestations, and case study examples.

Grand corruption in energy transition

Energy transition refers to the process of reframing the ways in which energy is produced and consumed to address the impacts of human-induced climate change (Acheampong 2022:7). Considering the extent of this transformation, which aims to drastically reduce greenhouse gas (GHG) emissions, it is no surprise that energy transition is considered a “green industrial revolution” (Clarke and Cooke 2014; Acheampong 2022).

As with any significant economic transformation, energy transition disrupts the existing power structures and creates new winners and losers. Thus, at the outset, it is important to keep in mind that contextual factors, such as levels of economic development and quality of institutions can influence how powerful political and business interests will react to new constraints and opportunities that the energy transition brings. These factors may intervene and shape the impact that grand corruption has on the efforts to achieve green transition, as well as the likelihood of it materializing.

As a huge endeavour, energy transition requires a lot of financial resources. Some estimates suggest that a decarbonised energy sector would need from tens to hundreds of trillions of dollars between now and 2050 (Sovacool 2021). A portion of these resources can be lost to corruption and, as we will see in the following sections, grand corruption risks are an important challenge in the efforts to efficiently use financial resources to tackle climate change.

Rimšaité (2019:265; Sovacool 2021) emphasises three reasons why energy transition is vulnerable to corruption risks:

- as a capital-intensive sector, energy markets are prone to control by a small number of actors, especially regulators (making it vulnerable to regulatory capture) and government, which can pursue policies that limit the ability of private companies to implement projects;

- the sector is characterised by a close cooperation between political and business actors, which opens a space for collusion between these networks; and

- it includes large value public procurement contracts, which, as literature in other industries suggests, are particularly vulnerable to corruption risks (Fazekas and Tóth 2016; Fazekas and King 2018; Dahlström et al. 2021; see also Mungiu-Pippidi 2015).

Decarbonisation

Decarbonisation refers to efforts to reduce the dependency on fossil fuel energy. After the 2015 Paris Agreement (UNFCCC, no date a), which resulted in an international treaty with the goal of keeping global warming well below 2°C and preferably 1.5°C relative to pre-industrial levels, many countries have declared ambitions to reduce GHG emissions (D’Arcangelo et al. 2022).

A range of different policies may be adopted to reduce dependency on fossil fuels. D’Arcangelo et al. (2022:37) suggest that an effective decarbonisation strategy should rely on a comprehensive policy mix that includes:

- emission pricing instruments (these include GHG taxes, emission trading schemes (ETS) and other instruments based on incentives, such as taxes on polluting goods)

- standards, regulations and subsidies to incentivise the adoption of low-carbon technologies (e.g. emission quotas)

- complementary and framework policies that create favourable economic and social conditions by lowering the costs of decarbonisation efforts

The exact shape of these policies vary across countries and depend on political constraints, social preferences, levels of economic development and the quality of institutions among other factors (see D’Arcangelo et al. 2022).

Since the process of decarbonisation disrupts the power of businesses that rely on fossil fuels and creates new winners and losers, some actors may rely on grand corruption as a way to limit or reverse the process.

Corruption may undermine the effectiveness of carbon tax and make it more difficult for the government to win public support to adopt ambitious policies, as public may be less supportive of these policies if their adoption and specific characteristics are influenced by corrupt actors (Conway and Hermann 2021). Further, the literature suggests that a better control of corruption is associated with more support for reforming the fuel subsidy system (McCulloch et al. 2021). For example, some evidence suggests that the perceived corruption of local governments increases citizens’ resistance to replacing fossil fuel subsidies with targeted spending (Kyle 2018). At the most general level, some studies find a positive correlation between corruption and higher carbon dioxide emissions (Leitão 2021; Sahoo et al. 2021).

State capture in decarbonisation

Some evidence of state capture has been identified in relation to carbon tax policies. Carbon tax is considered to be one of the most efficient policies to reduce carbon emissions as it incentivises economies to move towards alternative energy sources (Ceballos 2021). Carbon tax is susceptible to corruption risks at various stages of the policy cycle, including adoption, implementation and evaluation (Ceballos 2021; Conway and Hermann 2021). Already at the adoption phase, various special interests, which may include lobby groups, corporations, high emitters, auditors and politically connected businesses, may push for favourable treatment (e.g. tailor-made carbon tax) (Ceballos 2021). Some of these groups operate in a grey area of legality, as we will discuss more in the section on lobbying and unequal access to decision makers.

In Indonesia, the process of carbon tax adoption has been characterised by the influence of powerful business groups and businesspeople turned politicians in what resembles a state capture dynamic. Namely, evidence suggests that the political involvement of businesspeople in political parties and government institutions in Indonesia was the key reason for political resistance towards the introduction of a carbon tax (Dyarto and Setyawan 2020:1485).

This transition process from business to politics has made the business elite particularly influential on the policymaking process in Indonesia (Dyarto and Setyawan 2020:1485). Moreover, large companies have a structural power as well, considering that they are the key economic players in the country (Dyarto and Setyawan 2020).

Although the Indonesian government has announced the introduction of the carbon tax since then, the very low tax rate is likely to have a minimal impact on emission reductions (Conway and Hermann 2021:5). Moreover, the implementation of the carbon tax, which should have started in April 2020, has already been delayed twice (Partogi and Muhariastuti 2022; Reuters 2022; Jakarta Globe 2022).

Regulatory capture in decarbonisation

Revolving door practices may trigger regulatory capture in the decarbonisation sphere favouring narrow business interests over public interest. Even if regulations prevent politicians from having active business interests, the transition of lobbyists and businesspeople into regulatory agencies may lead to capture.

The example from the United States suggests evidence of shifting to industry special interests in the Environmental Protection Agency (EPA) in the starting period of Donald Trump’s administration (Dillion et al. 2018) which resulted in an important shift in previous policies and practices of the EPA.

Energy companies contributed hundreds of thousands of dollars to political action committees run by or supporting Donald Trump’s nominee to lead the EPA, Oklahoma Attorney General Scott Pruitt. Pruitt was previously vocal against Barack Obama’s climate policies and, particularly, regulations imposed on the fossil fuel industry (Dennis 2017). In 2018, former coal lobbyist Andrew Wheeler was appointed the No. 2 at the EPA (Lavelle 2018).

The study analyses the changes in EPA policy during the Trump administration and concludes that there was a shift in favour of business interests (the authors do caution that the identified practices do not conform with full regulatory capture) (Guillen and Whieldon 2017; Dillion et al.2018; Lavelle 2018). This manifested in political appointments of people close to the coal industry, allowing lobbyists on scientific advisory boards and prioritisation of regulatory rollbacks (Dillion et al. 2018:90-92). This study is particularly relevant for two reasons: i) it provides tentative evidence for the potentially negative effects of revolving door practices on favouring industry interests in the energy sector and ii) it sheds light on how political donations and lobbying may lead to unequal access to decision makers into favourable policies for narrow interest groups.

Thus, revolving door practices can be a dangerous bridge towards regulatory capture, which suggest the importance of properly monitoring and regulating these movements. Recent evidence from the UK suggests that revolving door is a widespread practice across a range of industries, including fossil fuels. For example, Open Democracy (2022) revealed that a former British Gas director became responsible for setting the energy price cap at Ofgem, the UK’s energy regulator (Bychawski 2022). This is one example out of at least 10 other senior officials recruited to top roles at the Department of Business, Energy and Industrial Strategy from the energy and oil sectors (Bychawski 2022).

Further, recent research revealed at least 71 cases of revolving door consisting of EU Commission advisers, MEPs, EU ambassadors, national MPs, and energy and financial ministers who held public offices before they moved to fossil fuel companies,d4f65154e1fd and vice versa, which carries the danger of conflict of interest and regulatory capture (Sanchez Nicholas 2021).

Institutionalised grand corruption in decarbonisation

Examples of institutionalised grand corruption related to decarbonisation policies can be found in resource rich countries with regards to fossil fuel subsidies. Data suggest that US$423 billion is spent annually to subsidise fossil fuels for consumers (UNDP 2021). These subsidies have a range of negative consequences, including lock-in of inefficient technologies, redirection of state funds from productive goals and environmental harm (see Rentschler and Bazilian 2016; Coady et al. 2017; Sovacool 2017; Rentschler and Hosoe 2022). Despite their broad negative effects, attempts to put an end to fossil fuel subsidies have been followed by popular backlashes in various contexts, including Nigeria, Kazakhstan, Ecuador, France, Lebanon and elsewhere (IISD 2019; Kasturi 2022; Stronski 2022)

Fuel subsidies often help to sustain patronage networks in non-democratic regimes, as the example of Nigeria suggests, where fossil fuel subsidies are intimately tied to government corruption and a lack of public trust in the government (Ladislaw and Cuyler 2015). The Nigerian National Petroleum Corporation (NNPC)ab9428d09d4f was an important source of siphoning public funds to various politically connected interest groups (Akanle and Adebayo 2013:96).

For example, in 2016, auditors revealed that the NNPC failed to pay US$16 billion to the government as officials from the previous administration allegedly engaged in siphoning billions of dollars of oil funds (BBC 2016). Further, KPMG auditors revealed that between 2007 and 2009 the NNPC over-deducted subsidy claims to the amount of N28.5 billion (approx. US$650 million) (KPMG 2010).

Akanle and Adebayo (2013) note the importance of oil importers in corrupt networks of fossil fuel subsidies. They act as middlemen between the NNPC and the international oil market to procure refined fuel and then distribute it to local consumers at subsidised rates (Akanle and Adebayo 2013:96). These actors had close ties with political officeholders in the Nigerian government, while many serve as fronts for politicians directly benefiting from fuel subsidy corruption (Akanle and Adebayo 2013:96). In 2012, evidence of fuel subsidy fraud was revealed, consisting of collecting subsidies for fuel that never existed, issuing false invoices, etc. (Reuters Staff 2012; Akanle and Adebayo 2013). The corruption risks were increased mainly due to a dramatic increase in the number of fuel importers, from 5 in 2006, to 140 in 2011.

In Indonesia, fossil fuel subsidy reform was tied to different special interest groups that benefited from the subsidies, including vehicle manufacturers and distributors, and state-owned oil companies (Chelminski 2018).

Lobbying and other grey areas in decarbonisation

The available data suggests that oil and gas companies spend huge amounts of money on lobbying to block climate change policies (McCarthy 2019). Unequal access to lobbying can lead to the undue influence of some stakeholders and potentially limit or reverse efforts of decarbonisation (Ceballos 2021). It opens a door to a number of corruption risks, some of which are petty forms of corruption (e.g. bribery, influence peddling) but some of which constitute grand corruption, such as regulatory capture, discussed in the previous section (see Mullard 2021; Nest and Mullard 2021).

Depending on the jurisdiction, unequal access to decision-making does not automatically constitute corruption, but it certainly raises integrity issues (Conway and Hermann 2021). There is abundant evidence on the disproportionate power of big oil and gas companies to influence decision makers. For example, between 2018 and 2021, oil and gas interests spent four times more than environmental advocacy groups and close to six times more than clean energy firms on lobbying in California (Slowiczek and Capital & Main 2022).

Research by the Influence Map (2019:2) estimates that, in three years following the Paris Agreement, the top five oil and gas companies invested more than US$1 billion on “misleading climate related branding and lobbying”. Close to US$200 million of this is spent yearly on lobbying to control, block or delay climate change policies (Influence Map 2019; McCarthy 2019). According to the Influence Map (2019), tactical use of social media by oil and gas giants is a key trend in these efforts, specifically ads that promote the benefits of fossil fuel production.

Data provided in an Influence Map report (2019:18) suggest that oil giants and their agents spent US$2 million on Facebook and Instagram ads to win key decisions around the US mid-term elections in 2018.

Further, lobbying efforts of oil and gas companies are sometimes characterised by declarative support to decarbonisation, but with conditions attached. For example, ExxonMobil made a US$1 million donation in 2018 to a lobbying campaign for a US federal carbon tax which also proposes the repeal of GHG emission standards under the US Clean Power Plan and immunity from all climate related lawsuits in the future (Irfan 2018; Influence Map 2019:11).

Since the Russian invasion of Ukraine and increased uncertainty in gas supplies in Europe, US exporters of fossil gas made huge financial gains. Namely, Cheniere, the US’s biggest exporter of liquified natural gas (LNG) increased its cash earnings by US$3.8 billion in the first six months of 2022 relative to the previous year (Global Witness 2022a, 2022b, 2022c). Moreover, LNG exporter companies, participated in the US-EU energy security taskforce which was set up in March 2022 in response to the Russian war in Ukraine. Global Witness (2022a, 2022b) notes the worry expressed by climate groups about a potential bias of the taskforce towards fossil gas interests. One reason is the appointment of a former US LNG industry executive as the US government lead representative in the taskforce, which raises risks of conflict of interest (Global Witness 2022b:5).

According to Global Witness (2022a, 2022b), the LNG Allies, a secretive lobby group, demanded and was granted five important concessions from US president Joe Biden after the Russian invasion on Ukraine. These included resuming fossil fuel leasing on US federal lands, authorising new US fossil gas infrastructure, approving funding for building infrastructure in Europe and speeding up six specific US LNG export licences.

Global Witness (2022b) suggests that the expansion of the US LNG infrastructure was not necessary to help Europe’s efforts to respond to the Russian invasion of Ukraine. Rather, it likely only benefits the gas industry, while it negatively affects local communities and stalls efforts to move away from fossil fuel infrastructure (Global Witness 2022b:8).

Further, Influence Map (2017) has found that the oil and gas industry successfully lobbied the UK government to get a minimum tax on North Sea operations. According to this report, it seems that the Treasury is making key tax policy decisions followed by consultations that seem to be effectively open only to oil and gas firms and their lobbyists (Influence Map 2017:2). Close relationship between the industry and the UK government is ensured via revolving door practices, industry secondments and political party funding (Lawrence and Davies 2015; Influence Map 2017). While revolving door practices do not automatically translate into any form of capture, cosy ties between the government and business in the UK have been shown in other industries to increase the risks of corruption or at least secure unequal access to decision makers (Resimić 2019).

Transnational component of grand corruption in decarbonisation

The transnational component of grand corruption in decarbonisation policies mainly relates to the disproportionate power of large oil and gas multinational companies who want to preserve the status quo or secure preferential treatment. Their influence typically manifests through unequal access to lobbying and foreign bribery.

For example, fossil fuel subsidies, one of the earlier mentioned barriers towards energy transition, are a frequent target of lobbying by multinational oil giants (Van Lierop 2019). Recent research from 2019 showed that the top five oil and gas companies and their fossil fuel lobby groups spent €251 million lobbying the EU since 2010 for, among other things, lucrative fossil fuel subsidies (Corporate Europe Observatory et al. 2019).

Foreign bribery also seems widespread among oil companies. For example, Vitol Inc., the US affiliate of the Vitol Group, the world’s biggest oil trading company, agreed to pay a hefty fine for oil bribes in Brazil, Mexico and Ecuador. For almost 15 years, Vitol was paying bribes to government officials to win lucrative business contracts (Kimani 2020; The US Department of Justice 2020). Further, Switzerland based mining company Glencore pleaded guilty to multiple accounts of bribery of government officials in West Africa and Latin America in exchange for preferential access to oil (Dempsey and Sheppard 2022).

A report that has just been published by Transparency International, which looks at the performance of 47 leading exporters in cracking down on foreign bribery by companies from their countries, shows worrying results (Dell and McDevitt 2022). Namely, only two countries, the United States and Switzerland, are in the category of active enforcement in the latest report, while most countries suffer from inadequacies in their legislation and institutions, which negatively affect enforcement against foreign bribery (Dell and McDevitt 2022).

Summary: Grand corruption and decarbonisation

Existing evidence of grand corruption risks in decarbonisation suggests that lobbying by gas and oil giants and the transnational component of grand corruption risks are the most prominent forms. This is likely related to the fact that oil and gas multinational corporations have a vested interest in delaying various decarbonisation policies, such as carbon tax or the elimination of fossil fuel subsidies, and they tend to rely on their disproportionate financial means to influence decision makers in countries where their businesses operate. A detailed summary is provided in Table A1.

Negative consequences of grand corruption in decarbonisation

Grand corruption in decarbonisation may have serious negative consequences on the efforts to reduce countries’ dependency on fossil fuels.

The continuation of fossil fuel subsidies that may happen due to grand corruption has a range of economic, social and environmental costs:

- they can overburden government budgets, thus limiting resources for more efficient use

- they can decrease the competitiveness of low-carbon industries, thus blocking the energy transition

- they can compromise energy security

- they can damage public health (e.g. increased air pollution) (Whitley and van der Burg 2015:10).

Grand corruption in decarbonisation policies can also significantly delay efforts to decarbonise the economy. Examples from previous sections (e.g. Indonesia) suggest that vested interests in different contexts can delay the adoption of different policies, such as the carbon tax on GHG.

Corruption can inhibit public acceptance towards ending environmentally harmful policies, such as fossil fuel subsidies, as evidenced from different contexts, including Indonesia suggest (Kyle 2018).

Table 1: Summary of the key findings on grand corruption in decarbonisation: key forms, manifestations, actors, and examples.

|

Key manifestations |

Key Actors |

Examples |

|

State capture in decarbonisation may occur at different stages of the policy cycle. There is evidence of state capture in carbon tax policies, manifesting in the influence of businesspeople-turned-politicians on decision-making in some contexts. |

|

An example is the carbon tax implementation process in Indonesia (Dyarto and Setyawan 2020). |

|

Regulatory capture in decarbonisation may be triggered by revolving door practices. These movements, in some cases, can lead to favouring narrow business interests at the expense of environmental concerns. |

Some examples of shifting to industry special interests can be found in the US (Dillion et al. 2018). |

|

|

Institutionalised grand corruption in decarbonisation may occur in relation to the distribution of fossil fuel subsidies. The evidence suggests that in weakly institutionalised contexts, legal loopholes and informal networks between politics and businesses may be used to siphon public resources into the hands of politically connected businesses. |

An example of Nigeria (Ladislaw and Cuyler 2015) suggests how fuel subsidies may be used to sustain patronage networks in non-democratic political regimes. |

|

|

Lobbying in decarbonisation can become a public concern when oil and gas giants use their disproportionate influence to access decision makers to shape the design of different policies, primarily carbon taxes and fossil fuel subsidies. Evidence suggests that the Russian invasion of Ukraine already has an important impact on decarbonisation efforts as it provides leverage for fossil fuel industries to push for policies favourable to them. |

There is rich evidence on the disproportionate power of big oil and gas companies to influence decision makers: these firms spend much more on lobbying compared to environmental and clean energy groups in California, for example, (Slowiczek and Capital & Main 2022), and evidence suggests that gas and oil giants spend huge sums on “misleading climate related branding and lobbying” (Influence Map 2019:2). |

|

|

The transnational component of grand corruption in decarbonisation relates to unequal access to lobbying by multinational oil and gas corporations and foreign bribery. |

Fossil fuel subsidies are a frequent target of lobbying by multinational oil giants (Van Lierop 2019). Foreign bribery in exchange for lucrative contracts is also present, as evidence from Brazil, Mexico and Ecuador suggest (Kimani 2020; The US Department of Justice 2020). |

Renewables

Renewable energy technology can be broadly divided into two groups: dispatchable, such as solar, biomass and hydropower, and non-dispatchable,d01ce83f63c7 such as wind power, photovoltaic cells and ocean power (Rahman 2020: 3). Existing research (Lawrence 2008; Dunlap 2019; Gallop et al. 2019; Sovacool 2021) has documented evidence of grand corruption across different types of renewable energy technologies, suggesting that none is immune to corruption risks. For example, a recent study using panel data on lower, middle and high-income countries between 2000-2017 found a positive relationship between control of corruption and green energy efficiency (Ozturk et al. 2019).

Nevertheless, it is important to note that there may be differences in forms of grand corruption depending on:

- the type of renewable technology involved (Sovacool 2021)a10165b1421d

- local contextual factors, such as levels of economic development and quality of institutions (Moliterni 2017)

- stage of the policy cycle (Sovacool 2021)

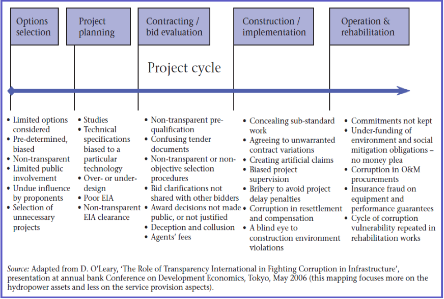

Haas (2008) provides a useful overview of corruption risks in the policy cycle of hydropower projects (Figure 1).

Figure 1. Hydropower project cycle and corruption risks.

Source Haas 2008:88. See also Sovacool 2021.

State capture in renewables

This section provides empirical evidence on state capture, addressing the structure of grand corruption networks in renewable energy transition. While this section draws on examples from the Western Balkans, the governance challenges that these countries face are not atypical, as case study evidence from other contexts suggest, thus their relevance goes beyond the region.

The Western Balkans experienced a boom in the construction of small hydropower plants over the last decade, primarily incentivised through public support in the form of feed-in tariffs.2b456b9fa11c While the original plan was to use these incentives for all types of renewables, they predominantly went to small hydropower plant projects (e.g., in 2018, these projects received 70% of support) (Gallop et al. 2019). However, there is a mismatch between the support for hydropower plants and their contribution to electricity generation.9b805fccadd4 Moreover, they have caused public protests across the Western Balkans due to the environmental damage related to their construction and operation (Gallop et al. 2019).

In most Western Balkan countries, these projects have benefited businesspeople connected to political parties in power, exemplifying patterns of institutionalised grand corruption, as will be discussed in the following section (Kostić and Đorđević 2018).

In some cases, such as Montenegro, these projects, in addition to institutionalised grand corruption, have elements of the state capture dynamic (Ćalović Marković et al. 2018; Gallop et al. 2019).

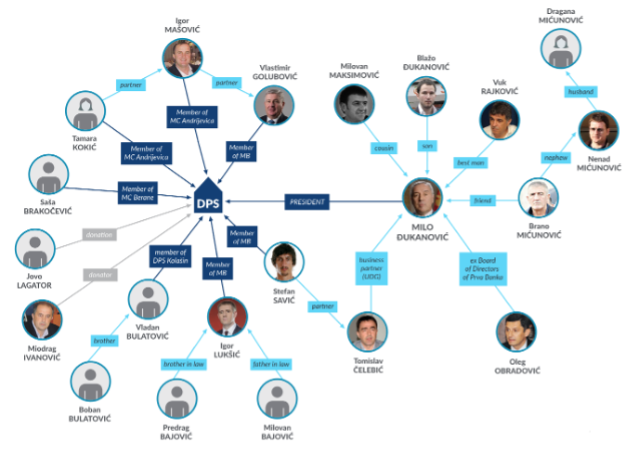

In Montenegro, a country characterised as a mafia state in the academic literature (Magyar 2016), the renewable incentive system has mainly benefited the crony circle around the president, Milo Đukanović (Figure 2) (MANS 2017; Ćalović Marković et al. 2018; Gallop et al. 2019), consisting of his family members, business associates and political officeholders from the then ruling political party Democratic Party of Socialists (DPS).

Figure 2. The network of actors involved in small hydropower plant projects in Montenegro.

Source: Ćalović Marković et al. 2018:6.

Changes to the Law on Energy in 2015 and the Law on Value Added Tax in 2017 created several provisions favourable to companies engaged in the renewable energy sector (Ćalović Marković et al. 2018). Namely, the production of energy from renewable sources was declared to be a public interest and citizens became obliged to pay a special tax to support renewable energy sources. The owners of small hydropower plants were guaranteed that all the electricity they produced would be bought. Moreover, the government, under the claim of public interest, expropriated land from private owners in several locations and later granted concessions to private firms (Ćalović Marković et al. 2018:2-3).

As of 2017, there were ten small hydropower plants in Montenegro. Afterwards, the government granted concessions to 47 additional plants. The investigation into the ownership structure of the winners of these concessions suggests that at least 50% were connected to DPS (Ćalović Marković et al. 2018:3).

As elsewhere in the Western Balkans, the outcomes of these projects in Montenegro were suboptimal. Namely, a MANS Investigation Center (Ćalović Marković et al. 2018) study showed that the state has earned less than €500,000 in four years, whereas concessionaires, through the taxes paid by citizens in their electricity bills earned close to €5 million in less than three years, suggesting that narrow business interests profited from these arrangements (MANS 2017; Ćalović Marković et al. 2018:9).

Research on North Macedonia has documented evidence on tailor-made laws in the environmental sector. In a regulation4dd934a5c9cd setting the conditions to produce electricity from renewable sources, two types of support were introduced for producers, the above mentioned feed-in tariffs and premiums. These provisions particularly favoured hydropower producers, some of which were politically connected (Balkan Green Energy News 2019; Zúñiga 2020: 17-18; Taseva 2020; Resimić 2022a:11). Namely, they particularly benefited Small Hydro Power Plants Skopje, a company whose manager was a businessman, Todor Angjušev, the brother of the Deputy Prime Minister for Economic Affairs at the time, Kočo Angjushev (Zúñiga 2020).

Furthermore, Kočo Angjušev, was a major shareholder in the firm Feroinvest, which owned a number of small hydropower plants in North Macedonia (Gallop et al. 2019). Although Angjušev stepped down from a management position in Feroinvest in 2016, he was involved in drafting the legislation on renewable energy sources as a political officeholder, which raises the issue of conflict of interest and a risk of state capture (see Zúñiga 2020:18; Gadžovska Spasovska and Kalinski 2019; Taseva 2020:32). This is because Angjušev directly or indirectly controls a third of the small hydropower plants in the country (Gadžovska Spasovska and Kalinski 2019). In 2019, there was an investigation by the State Anti-Corruption Commission to determine how Feroinvest obtained the rights to use a piece of land for one of its small hydropower plants (Gallop et al. 2019:33).

Another politician from North Macedonia, Hristijan Mickoski, won at least five concessions through his private company while he was serving as the director of a state-owned electricity production company and an energy adviser to former prime minister Nikola Gruevski (Gallop et al. 2019:33; Tim 24 2019). He came under investigation by the State Commission for the Prevention of Corruption for the procedure under which he received the concessions (Gallop et al. 2019:33; Tim 24 2019).

Institutionalised grand corruption in renewables

The most typical form of grand corruption occurring in renewables, based on existing research, is institutionalised grand corruption. As a reminder, the difference between state capture and institutionalised grand corruption is that the former refers to the illicit influence on the formation of rules, whereas the latter refers to illicit influence on their implementation (bending existing rules and regulations to achieve narrow benefits). Political connections are an important feature of both manifestations of grand corruption, but the difference is in the target of capture.

There is rich evidence from several Western Balkan countries, demonstrating the existence of institutionalised grand corruption. These cases show how public funds can be diverted to finance suboptimal projects related to climate change.

For example, research from Serbia suggests that hydroelectric power plants owned by the state company Serbian Electric Power Industry (EPS) and those connected to Nikola Petrović, a businessman and best man to President Aleksandar Vučić, received over €21 million. This amount is more than half of what Serbian citizens paid for the electricity generated in hydroelectric power stations between 2013 and 2016 (Kostić and Đorđević 2018).

While not necessarily suggesting corruption, firms with strong political connections benefiting from public financing for small hydropower plants indicate the existence of serious corruption risks (Gallop et al. 2019). This is even more so considering the existing evidence on the extent of politicisation and state capture in the Serbian economy and the economies of other Western Balkan countries (Duri 2021; Resimić 2022b). Deeply rooted patronage networks and the politicisation of economies lead to the targeted awarding of concessions and public procurement contracts to ruling political elites and their crony networks (Duri 2021; Resimić 2022a, 2022b). Climate change related projects are not an exception in any way. Moreover, concessions for small hydropower plants were not only granted to politically connected businesses in Serbia but also to figures linked to organised crime (Đorđević 2020).

Links between subsidised renewable energy projects and political-business criminal networks have been identified elsewhere as well. For example, a study by Gennaioli and Tavoni (2016) focuses on the links between public policy and corruption in wind energy. They find that illicit ties between businesses and politicians can influence the licensing process in subsidised renewable energy schemes (Gennaioli and Tavoni 2016).

Evidence from Kenya suggests that political officeholders frequently use their political power to allocate resources for solar projects to their ethnic groups, exemplifying the patterns of institutionalised grand corruption, with consequences such as inefficient allocation of resources and diversion of public spending (Sovacool 2021). A study by Boamah et al. (2021) offers evidence of the widespread use of political connections in securing public procurement contracts in Kenya. This practice is so widespread that there is a special colloquialism, “tenderpreneur” to describe a businessperson who relies on political ties to secure public procurement contracts (Piper and Charman 2018; Boamah et al. 2021:8).

Lucrative projects in renewables can be an attractive source of institutionalised grand corruption. For example, evidence from China (Haas 2008) and elsewhere suggests that big dam projects carry high risks of grand corruption due to their lucrative nature. This potential for grand corruption can be so decisive as to direct policymaking to the most lucrative investment projects (Butterworth and de la Harpe 2009; Sovacool 2021).

For example, there is evidence of institutionalised grand corruption in Malaysia through directing hydropower contracts to companies tied to the family of the chief minister of Sarawak, Mahmud Taib (Bruno Manser Fund 2013; Sovacool 2021). There are allegations of public spending for large dams being diverted to the Taib family, who remained in political power in the state of Sarawak, and to companies connected to this family (Sovacool 2021:10). This suggests that the allocation of dam contracts is particularly prone to corruption, especially in this phase when corrupt practices, such as different forms of tender rigging, can systematically divert resources to politically connected firms at the expense of public interest. This process involves the collusion of various actors, including private firms, banks, national energy companies, political parties, government and state bureaucrats (Sovacool 2021:10).

There is also evidence of the diversion of state funds by the ruling political parties in Uganda. The Global Energy Feed-in Tariff Uganda (GET FiT), a green intervention mechanism to address the challenge of Uganda’s overreliance on environmentally harmful dams, was characterised by delays, which were attributed to institutional corruption at Uganda’s Electricity Transmission Company (UETC) (Redd 2021). UETC was missing funds necessary for building one of the critical substations. Allegedly, these funds were partly used to fund the electoral campaign of one of the political parties in 2016, the National Resistance Movement (NRM) (Redd 2021).

Further, recent convictions in Croatia in connection with procurement contracts for a solar power plant and a wastewater treatment facility illustrate how petty forms of corruption are part of a more complex chain of institutionalised grand corruption. Three people were found guilty of illegal favouritism and attempt of abuse of office (EPPO 2022). They were previously accused of manipulating the public procurement procedure of the aforementioned projects funded by the European Union Cohesion Fund and the European Regional Development Fund (EPPO 2022). Two of the accused, the manager of a private company and the mayor of Nova Gradiska, were manipulating public procurement documentation to favour a particular firm (EPPO 2022). Although this case refers to a small number of companies, it fits into a broader pattern of institutionalised grand corruption, whose aim is to systematically redirect state resources to politically connected firms (Fazekas and Tóth 2016).

Transnational component of grand corruption in renewables

Grand corruption in renewable energy transition has, in some cases, a transnational component. The complexity and international nature of big projects can provide a fertile ground for transnational corruption (Butterworth and de la Harpe 2009). For example, evidence of state capture with a transnational dimension has been found in solar projects in South Africa (Joubert 2016), a country with a history of serious problems with state capture under former president Jacob Zuma (Alence and Pitcher 2019). This case illustrates two alleged threats to solar energy transition in South Africa: i) efforts to stall these projects by government connected private coal industry interests, and ii) negative consequences of solar projects for local communities.

Firstly, the Ministry of Energy of South Africa started a programme of renewable energy plant projects (including solar, biomass, wind, and others) in 2011 which opened the door for private companies to bid for building such plants (Joubert 2016). In 2016, the national utility company Eskom stalled the approval of the last batch of plants citing concerns about the financial sustainability of the programme (Joubert 2016). This move coincided with the publication of the report on state capture issued by the Office of the Public Protector which tracks corrupt networks involving an Indian family, called Gupta, who have business interests in the coal industry, and who have allegedly exerted influence at the highest levels of the South African government (Joubert 2016; Sovacool 2021).

Investigation into corrupt networks around former president Jakob Zuma, among many other issues, points to the alleged corrupt practices of Eskom and the influence on contract awarding and policy formation by the Gupta family (Cocks 2022). The fourth report of the Zondo commissiona1339c89bdc4 accuses former president Jacob Zuma of helping the Gupta brothers to pursue their interest in the coal industry by taking control of Eskom, the largest electricity producer in Africa. Once a healthy company, Eskom became heavily indebted over the years due to corrupt practices (Chanson 2022).

Secondly, the available evidence suggests that the outcomes of many solar projects in South Africa have been exclusionary and exploitative for those living nearby these developments (Sovacool et al. 2019; Sovacool 2021). Moreover, in some of the approved projects, community trusts were established without the consent of local communities, resulting in the appropriation of community assets, including land, for solar plant projects (Sovacool et al. 2019; Sovacool 2021).

Further, firms and politicians with business connections in the Global North can be the drivers of grand corruption risks in the developing world (Rahman 2020:5). For example, one former UK minister, Sandip Verma, has been accused of violating the ministerial code after her family firm signed a multimillion deal to supply Uganda’s government with solar power equipment (Rahman 2020:5; Syal 2020). In another case, the Anti-Corruption Prosecutor’s Office in Spain charged an energy firm, Duro Felguera with crimes of international corruption and money laundering. The allegations involved paying bribes to senior Venezuelan officials to obtain contracts to build an energy plant (Dell 2020:10).

Summary: Grand corruption and renewable energy transition

The existing evidence of grand corruption in renewable energy transition suggests that institutionalised grand corruption is the most prominent form. This is likely related to the fact that the process of renewable energy transition involves large public procurement contracts, state subsidy schemes and other incentives which can be redirected to politically connected actors. A detailed summary is provided in Table A1.

The negative consequences of grand corruption on the renewable energy transition

How does grand corruption undermine international efforts to promote the transition to renewable energy sources? Existing evidence suggests the following negative consequences.

For example, a common feature in the Western Balkan countries pursuing small hydropower plant projects was the poor enforcement of environment protection laws. Consequently, state subsidies and lax regulations had serious negative environmental consequences in some cases, as mentioned in the previous section (Đorđević 2020). The procedures for ensuring environmental protection prior to issuing permits for plants were often bypassed: at least 24 out of 166 small hydropower plants – around 20% – connected to the Serbian national grid in 2019 were constructed without key environmental permits (Đorđević 2020). Poor enforcement and lax regulations create a fertile ground for corruption, especially in contexts with strong ties between politics and business, which is the case in the Western Balkans (Đorđević 2020).

Furthermore, these small hydropower plant projects were harmful for local communities in Montenegro and elsewhere in the Western Balkans. They frequently resulted in the local population being deprived of water for irrigation and for animals to drink, disrupted riverbanks and caused deforestation in the process of creating access for the construction of pipelines (Gallop et al. 2019; Todorović 2020).

Corruption has also been found to increase the cost of renewable energy projects, and these costs can affect any stakeholder in the energy sector (see Table 1 below) (Lu et al. 2019). A study from Bangladesh has found evidence that the capital cost of power plants is twice of the global average (Debnath and Mourshed 2018). The study also finds evidence that higher corruption increases capital costs (Debnath and Mourshed 2018).

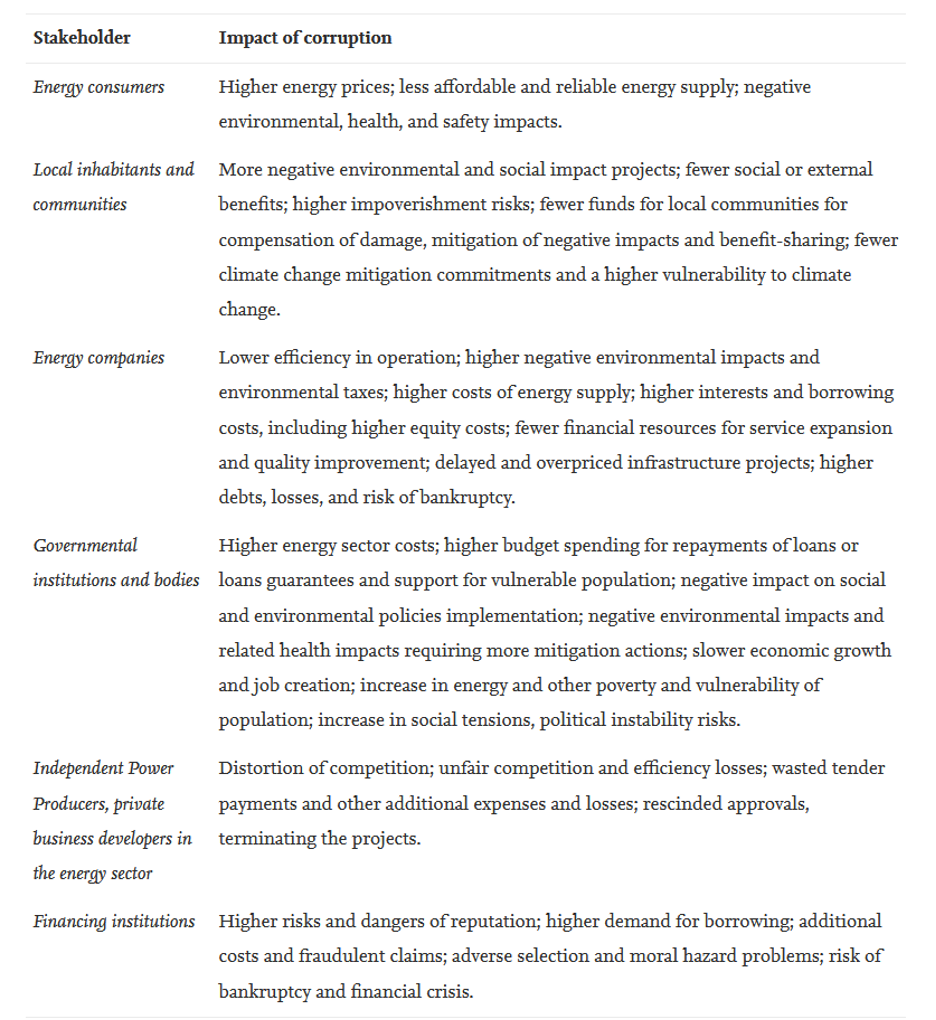

A recent study by Sovacool (2021) identifies the negative effects of corruption on different energy stakeholders (Figure 3).

Figure 3. Impact of corruption on different energy stakeholders.

Source: Sovacool 2021:5.

Table 2: Summary of the key findings on grand corruption in renewables: key forms, manifestations, actors, and examples.

|

Key manifestations |

Key Actors |

Examples |

|

State capture in renewables may manifest through tailor-made legislation benefiting politically connected businesses. |

|

Examples of these practices can be found in North Macedonia and Montenegro in relation to incentives for hydropower plant projects within renewable energy transition (MANS 2017; Taseva 2020).

|

|

Institutionalised grand corruption in renewables manifests through the diversion of public funds into the hands of political and business elites by bending the regulations. Politicised allocation of resources is the main characteristic of this form of corruption. |

Examples of these practices can be found in small hydropower plant projects in Serbia, wind energy projects in Italy and solar projects in Kenya (Gennaioli and Tavoni 2016; Kostić and Đorđević 2018; Sovacool 2021). |

|

|

A transnational component of grand corruption in renewables may manifest through state capture by foreign multinational corporations and foreign bribery. |

Examples include state capture allegations in solar power projects in South Africa and foreign bribery in energy plant contracts in Venezuela (Sovacool et al. 2019; Dell 2020). |

Critical minerals

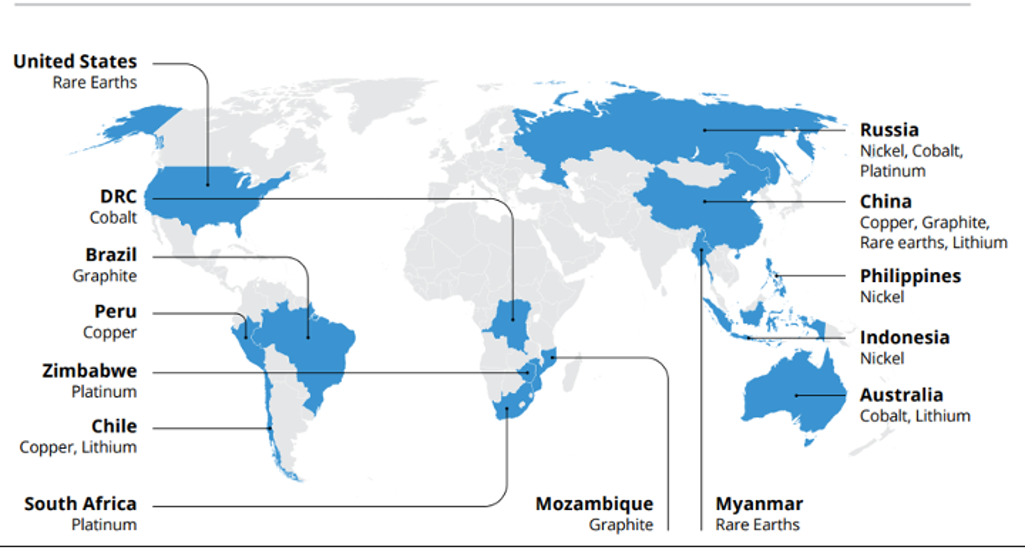

As we have seen in the previous sections, fast transition to renewable energy technologies is a necessary part of the efforts to curb climate change and reduce dependency on fossil fuels. Critical minerals are an essential element of the renewable energy transition (Church and Crawford 2020). To manufacture renewable technologies, different critical minerals, such as lithium, nickel, cobalt, rare earth minerals, copper, aluminium, are needed (The African Climate Foundation 2022).

This need for critical minerals creates some important challenges as there are risks of grand corruption. As in the case of renewables, contextual factors may be enablers of grand corruption in critical minerals. Thus, it is important to be mindful of local contexts when analysing the links between grand corruption and climate change policies. An important challenge is that many critical minerals necessary for renewable transition are located in countries characterised by high levels of corruption (See Figure 4) (Caripis 2022).

Figure 4. Top producers of critical minerals.

Source: Caripis 2022 (Adapted from IEA (2021) The Role of Critical Minerals in Clean Energy Transitions).

In general, the mining process itself is vulnerable to corruption risks as case studies in Transparency International’s Accountable Mining Programme have shown. This is particularly the case for the licensing process (when governments decide whether to approve a mining project or not), where grand corruption can be a risk, as will be discussed in the following sections (Caripis 2022). With regards to mining approvals, somewhat surprisingly, a Transparency International study (Caripis 2017) has shown that context is less relevant, and that corruption risks exist across the globe regardless of the country’s levels of economic development, political context, geography or the size of the mining sector.

Caripis (2022) suggests three broad reasons for an expected increase in corruption risks in energy transitions related to critical minerals:

- There are more and more mining companies willing to operate in countries that were previously perceived as risky to invest in. That means many more companies, which either have poor anti-corruption safeguards or do not care for corruption altogether, will enter the critical mineral markets.

- There is a greater participation of the state in the critical minerals boom. This creates the danger of a “race to the bottom” in regulatory standards to attract investment. Additionally, governments may require foreign investors to partner with local suppliers, which opens the space for favourable treatment of politically connected businesses.

- The increase in demand will additionally burden the institutions which are under-resourced to begin with, thus increasing risks of bribery in the licensing process.

Mining approvals are, by their nature, contested as they involve many different stakeholders (including mining companies, governments, affected communities, civil society) who all assign a different value to mining projects (Grice 2021:10). The combination of these various interests on the one hand with characteristics of the sector on the other, such as large capital expenditure and close interaction with public officials for licences approvals, further exacerbate corruption risks (Grice 2021:11).

Moreover, the COVID-19 pandemic had an impact on corruption risks, considering that some governments further relaxed licensing conditions during the pandemic and that governments in many jurisdictions classified mining as an essential industry during the pandemic (Grice and Bieske 2021; Grice 2021).

A boom in critical minerals can also bring important negative environmental consequences. A study in Nature has found that threats to biodiversity caused by mining may be higher than those averted by climate change mitigation (Sonter et al. 2020). Moreover, the mining industry performed surprisingly well during the pandemic, as it was deregulated in many countries and received incentives to mine critical minerals (van Halm 2022).

State capture in critical minerals

The legislative framework around mining rights has been shown to be vulnerable to state capture risks across different contexts.

In Armenia, there is some evidence of state capture affecting the allocation of mining rights. Mining companies may provide “charity” payments to different foundations prior to obtaining licences (Transparency International 2017:3). It appears that many of these foundations are related to the top-level political officeholders or leaders of the local communities affected by mining (Transparency International 2017:3). Cases exist where such payments were followed by legislative amendments favouring particular mining projects, thus exemplifying state capture (Transparency International 2017:3). These practices may suggest that donations were made to provide narrow benefits to mining companies at the expense of public interest.

In Australia, industry influence over the resource sector has been identified as a corruption risk in the governance of mining, with a potential for state capture (TI Australia 2017: 46). There are criminal investigations in Australia involving politicians with close links to the mining industry for corruptly influencing the mining approval process. In some cases, these investigations led to convictions (ICAC 2016; TI Australia 2017).

Further, a study on corruption risks in mining during the COVID-19 pandemic (Grice 2021:58) notes that many civil society representatives have raised concerns that corporate donations during the pandemic may increase the risk of state capture.

Regulatory capture in critical minerals

Evidence of capturing agencies that are central to issuing mining permits and regulating the sector is also found in the critical minerals sector.

In Guatemala, the revolving door between the Ministry of Energy and Mines and the Ministry of Environment and Natural Resources on the one hand and top-level positions in national mining companies, which are subsidiaries of multinationals, on the other, increase risks of regulatory capture (García and Lopez 2017:53). A number of former political officeholders in Guatemala had links to mining companies, either directly or indirectly through their family members, which blurs the boundaries between public and private interests (García and Lopez 2017). For example, ties were discovered between the ex-minister of energy and mines, Erick Archila Dehesa, his family and companies in the extractive sector, and decisions they made while in these positions may have benefited the private sector (García and Lopez 2017:69).

In the DRC, one important vulnerability to regulatory capture relates to the financial dependence of certain institutions, such as the reliance of the Mining Cadastre and Mining Administration on funding from applicant companies. Due to insufficient funds, the applicants for exploration or operating permits have to pay for the meetings of the Permanent Committee for the Evaluation of Environmental Plans (Kabongo and Hengelela 2017:30).

Institutionalised grand corruption in critical minerals

Institutionalised grand corruption in critical minerals is characterised by redirecting mining licences to politically connected companies.

In Indonesia, changes to the mining law introduced “an opaque system for auctioning mining zones” (Caripis 2017:6). Under this law, it was not clear how the mine work areas were determined, which opened a lot of space for the politicisation of the process and the capturing of the process of licence allocation (Caripis 2017). Unclear procedures allegedly enabled a provincial governor to issue licences and allocate forested areas in exchange for kickbacks (Caripis 2017).

The Armenian case suggests that companies engaged in mining are registered in offshore havens, which makes the identification of beneficial owners much harder. Additionally, Armenian law protects the identity of owners of joint stock companies (Transparency International 2017:3). Some evidence suggests that high-ranking political officeholders are behind some of the companies (Transparency International 2017; Caripis 2017). Investigative journalists discovered that the former minister of nature protection of Armenia gave licences to open dozens of mines to firms belonging to his family members (Caripis 2017:24).

The risks of institutionalised grand corruption are especially high when top-level government officials can interfere with licensing decisions for mining rights (Caripis 2017). In Zambia, a licensing committee in charge of evaluating applications of companies and granting licences has ministerial members delegated by the mining minister who also has an authority to overturn committees’ decisions as long as they provide a justification (Caripis 2017:50). This gives space for political interference in the licensing process, which may result in redirecting licences to politically connected companies. In 2015, the former mining minister of Zambia, Maxwell Mwale, was convicted of interfering with the licensing process (Reuters 2015; Caripis 2017).

Further, unclear criteria for evaluating tender bids and documentation are an important source of corruption risks. In Mongolia, there is evidence of a former member of a tender commission being allegedly pressured by senior officials to favour a particular bidder by manipulating the tender documentation for mineral licences (Caripis 2017:50; Biastoch 2017). One important issue relates to the discretionary power of important stakeholders. For example, in Guatemala, the time to process mining licences is largely arbitrary: it can take anywhere from 6 months to 4 years. This increases the risk of bribery to speed up the process (García and Lopez 2017:64). There is evidence alleging that the government led by the Patriot Party asked for payments for the minister to sign the award (García and Lopez 2017:64).

In Indonesia, there is evidence of widespread bribery in licensing, consisting of companies bribing regional leaders who have the authority to issue permits for exploration and exploitation of natural resources (Adjie 2020).

Lobbying and other grey areas in critical mining

The lack of transparency in lobbying activities has been an important source of grand corruption risks in critical minerals. In the absence of clear procedures, it is hard to follow the money and assess whether there has been an undue influence from interest groups on the formation of laws, rules and regulations that would benefit these interests at the expense of the public (Caripis 2017). In these cases, unequal access to lobbying and a lack of transparency can create fertile ground for state capture to emerge.f948949f5df6

In Transparency International’s study on accountable mining (Caripis 2017) the risk of mining laws being designed to favour narrow private interests has been assessed as high in six countries. Among others, a lack of transparency in lobbying and political donations was a typical source of this risk (Caripis 2017:30).

In Indonesia, there is evidence of mining companies claiming that candidates in provincial elections demanded donations in exchange for preferential treatment in mining licence allocation if they get elected (Caripis 2017:31).

Further, while Chile has established some controls on lobbying since 2014, there are still certain loopholes. While there is an obligation to disclose all meetings held with and requested by lobbyists, there is no obligation to do so for those meetings requested by the government or those that discuss “technical matters” (Caripis 2017:30; Cárcamo et al. 2017).

During the COVID-19 pandemic, mining companies directed their philanthropic activity to support the pandemic response in countries in which they operate (Grice 2021). While commendable, these kinds of donations also bring corruption risks, particularly from those mining companies which do not have proper business integrity systems in place (Grice 2021:57). Grice (2021:57) notes that some civil society organisations (CSOs) expressed concerns that mining companies may use their social investments for lobbying the governments to pursue their commercial interests, such as obtaining mining licences.

Grice’s study identified examples of mining companies lobbying during the pandemic to obtain licences or get tax breaks and other levies while using their contributions during the pandemic as an argument (Grice 2021). For example, in Australia, the Mineral Council of Australia stressed their economic contributions during the pandemic while calling for more competitive taxation and faster project approvals in a blog post on their website (Grice 2021:60).

In Mexico, CSO representatives expressed concerns that donations from mining companies during the pandemic for healthcare goods and services to support local communities have been used as leverage to get the support of these communities for mining interests in these companies’ dealings with the state (Grice 2021:61).

There are also concerns of unequal access, which is particularly troubling considering the evidence that unequal access to decision makers in climate policies can open the space for serious corruption risks (Mullard 2021). Namely, some CSO representatives in Mexico noted that the mining sector participated in the economic recovery talks with the government in 2021, while they were not invited (Grice 2021). Moreover, priority given to the mining industry in Mexico as an essential industry during the pandemic has created a situation of unequal access to the state (Grice 2021). CSOs note that different groups became affected differently in the pandemic: while the mining industry got easy access to decision makers, communities and CSOs had difficulties exercising their rights (Grice 2021:69).

Transnational aspect of grand corruption in critical minerals

The involvement of foreign multinational corporations is an important feature of the critical mineral markets. Some evidence suggests the existence of grand corruption risks.

In the DRC, the mining code of 2002 officially aimed to liberalise the sector and create a level playing field for mining companies. However, it further entrenched the privileged position of state-owned companiesfc3501d44822 as they could keep most of their valuable permits and sell them for concessions to other firms (The Carter Center 2017). State-owned firms typically had most of the mining rights “in commercially exploitable and profitable deposits” (Kabongo and Hengelela 2017:24; Caripis 2017). As a consequence, it became common for firms to obtain mining rights by getting into joint ventures with these state-owned companies. Blurry conditions for negotiating these join venture arrangements undermined the very procedure of licensing as per the mining code of 2002.

The Congolese state has sold assets at a sixth of their market value, on average, enabling huge profits for foreign firms (Caripis 2017). Moreover, most of these deals between state-owned companies and international private firms were conducted behind closed doors without proper tenders to identify the best qualified offer, raising the risks of corruption (Kabongo and Hengelela 2017:24; Caripis 2017).

An important challenge lies in the fact that in practice, Congolese state-owned companies sometimes take over the role of the state, while at other times operate as regular mining companies (Kabongo and Hengelela 2017:24). Consequently, these ambivalent governance practices make it harder to control them and open a door to corruption risks. This is particularly relevant considering the evidence of interference by political authorities, secret services and private interests in mining activities, as well as the direct involvement of top-level political office holders in mining contract negotiations (Kabongo and Hengelela 2017).

For example, there is evidence that in 2010 and 2011 an Israeli businessman, Dan Gertler, a close friend of Joseph Kabila, the Congolese president at the time, was a key intermediary through whom Glencore acquired stakes in Congolese mining ventures for cobalt production (Global Witness 2012; Kabongo and Hengelela 2017:33). These stakes were secretly, and at an undervalued price, divested to offshore companies, most of which were tied to Gertler (Global Witness 2012).

In 2017, under the Global Magnitsky Human Rights Accountability Act, former president Trump signed an executive order which sanctioned Dan Gertler, among others, (US Department of Treasury 2017). The executive order stated that in his role as middleman for mining asset sales in the DRC, the DRC reportedly lost more than US$1.36 billion in revenue from under-pricing mining assets that were then sold to offshore firms tied to Gertler (US Department of Treasury 2017).

In Guatemala, a leak of more than 8 million documents revealed how the mining company Solway captured local police and Indigenous leaders to counter local resistance to the extraction of nickel from Indigenous lands (El Faro 2022). There is also evidence of the influence of Solway on top-level government officials. Leaked documents reveal that when the Q’eqchi’ Ancestral Councils closed the road leading to the dig site during protests, Solway asked the government for help (El Faro 2022). A few days after the request, President Alejandro Giammattei declared martial law ,and security forces escorted trucks to the dig site and arrested a number of community leaders (El Faro 2022).

Further, corruption allegations exist about Chinese companies that operate in the DRC, also allegedly involving human rights violations through sub-contracting schemes (Castillo and Purdy 2022:16). For example, a DRC court ruling removed a Chinese company, China Molybdenum, from the leadership at the Tenke Fungurume copper-cobalt mine for six months. The company was accused of corruption, including underreporting mineral reserves to reduce annual payments as well as bribes to hide poor labour conditions (Castillo and Purdy 2022:16).

Finally, foreign bribery has been evidenced in critical minerals, particularly with regards to issuing licences. For example, in 2014 Alcoa World Alumina LLC pleaded guilty on charges that it paid millions of dollars in bribes through a middleman in London to officials in the Kingdom of Bahrain to secure business (The US Department of Justice 2014).

Summary: Grand corruption and critical minerals

Existing evidence of grand corruption in critical minerals suggests that the transnational component of grand corruption and unequal access to lobbying are the most prominent forms. This is likely related to the fact that multinational corporations typically play a key role in critical mineral supply chains and that obtaining mining licences are among the most essential steps in the process. A detailed summary is provided in Table A1.

The negative consequences of grand corruption in critical minerals

Grand corruption in critical minerals has a range of serious negative consequences as mentioned in the introduction to this section on critical minerals.

First, there is broad evidence linking grand corruption in critical minerals to environmental degradation. In Myanmar, a boom in illegal rare earths mining has fuelled environmental destruction, among other negative consequences. Global Witness (2022d) reports that there were more than 2,700 rare earth mining sites in North Myanmar by March 2022. As the process of extraction of rare earths are highly polluting, the consequences for the local ecosystems and access to drinking water were devastating (Global Witness 2022d, 2022e). Moreover, the expansion in rare earth mining is causing deforestation and the biodiversity loss of rare plants (Global Witness 2022d, 2022e). The beneficiaries of these illegal trades include local warlords who control militia units that are part of the Myanmar military’s chain of command (Global Witness 2022d, 2022e).

In Guatemala, current and former top-level political officeholders, including the current minister of energy and mines, Alberto Pimentel Mata, were accused of allowing the Fénix mine01880d14a6c3 to extract nickel, contrary to Guatemala’s top court ruling that extraction cannot be continued (Madureira 2022). Allegedly, the Fénix mine leached contaminated water into Lake Izabal polluting it with heavy metals (Madureira 2022; Moskowitz et al. 2022).

Second, grand corruption can divert public resources towards narrow interests. For example, there is evidence suggesting that mining plays a substantial role in financing armed groups in the DRC and also contributes to rent extraction (Faber et al. 2017; Callaway 2018; UN Environment Programme 2022). The UN Group of Experts on the DRC (2019) has found evidence of smuggling minerals by armed groups involving criminal networks as well as specific instances of some Congolese government officials being involved in the diversion of minerals. Further, hundreds of millions of dollars were lost at the DRC state-owned company Gécamines between 2011 and 2014, with direct ties between the missing money and multinational cobalt and copper mining firms (Callaway 2018:5).

Third, corruption in critical minerals also has negative consequences on labour rights. In the DRC, multinational companies largely rely on sub-contractors for supplying the workforce. This results in a two-tiered employment system, where workers employed through sub-contractors are subject to lower wages, lower or no benefits, and a lack of job security (RAID 2021:25). Some evidence suggests that Congolese government officials and their family members take advantage of this system by controlling companies that act as sub-contractors (Callaway 2018). For example, Bloomberg reported that the brother of former Congolese President Kabila owned a firm which acted as a sub-contractor for a Canadian mining firm (Wilson 2017; Callaway 2018).

Fourth, there is a range of human rights abuses linked to grand corruption in critical minerals. Namely, in the DRC, corruption within the Support and Supervision Service for Small Scale Mining (SAEMAPE), the government agency supposed to provide technical assistance, lead to safety problems for artisanal and small-scale miners (ASM) (Callaway 2018:19). Evidence suggests that SAEMAPE staff would tolerate digging deeper than the legal limit in exchange for payment, which creates a serious life risk for miners due to possible landslides and mine collapses (Callaway 2018:19). While these practices technically belong under lower levels of corruption, Callaway (2018) notes that they are deeply entrenched in the system of violent kleptocracy of the Congolese regime.

In Myanmar, Global Witness (2022d, 2022e) reveals that illegal trade in rare earth minerals is fuelling human rights abuses. A highly polluting extracting process required for these minerals is causing serious health issues for residents living near these mines, including respiratory diseases, osteoporosis and skin and eye problems. Moreover, civil society groups and Indigenous leaders are faced with death threats from militias for opposing this illicit mining (Global Witness 2022d, 2022e).

Table 3: Summary of the key findings on grand corruption in critical minerals: key forms, manifestations, actors, and examples.

|

Key manifestations |

Key Actors |

Examples |

|

State capture in critical minerals mainly relates to the procedure to obtain mining licences by influencing the law-making process. Blurry links between politics and business, as well as unclear procedures for corporate donations may increase these risks. |

|

Some evidence of state capture with regards to the allocation of mining rights can be found in Armenia (Transparency International 2017). |

|

Regulatory capture in critical minerals may develop out of overly-close ties between politics and business via revolving door practices, for example, as well as in cases of problematic institutional solutions that introduce relations of dependency between regulatory agencies and mining companies. |

Revolving door practices between mining ministries and mining companies in Peru increase risks of regulatory capture (García and Lopez 2017:53). |

|

|

Institutionalised grand corruption in critical minerals manifests in the diversion of public resources or business opportunities to politically connected businesses by bending rules, exploiting legal loopholes, or outright political interference. These practices thrive in contexts with too much discretion, unclear laws and authorities, and a lack of proper mechanisms to detect conflicts of interest. |

An example from Indonesia suggests that changes to the mining law introduced a lot of uncertainty with regards to auctioning mining zones and opened a door for politicisation of the process (Caripis 2017). |

|

|

Lobbying in critical minerals in contexts with poor and/or unclear regulations may result in unequal access to decision makers. These risks are particularly prominent since the COVID-19 pandemic when many companies redirected their philanthropic activities towards supporting pandemic challenges (Grice 2021). In contexts with unclear regulations, it becomes much harder to assess to what extent these and similar corporate contributions are used to exert undue influence on decision makers to obtain mining licences, tax breaks and other benefits. |

|

Some evidence from Indonesia suggests that provincial election candidates requested corporate donations in exchange for preferential treatment with regards to mining licenses (Caripis 2017) |

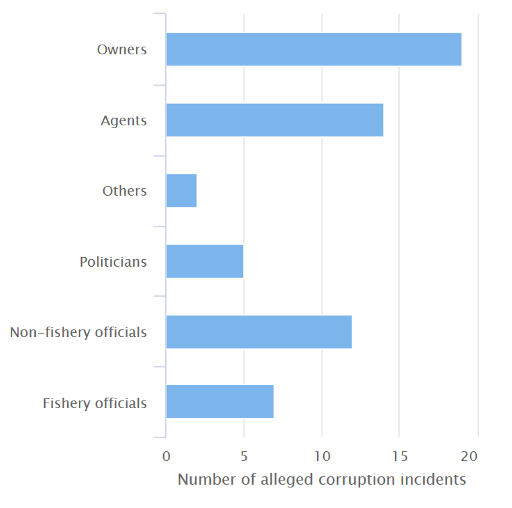

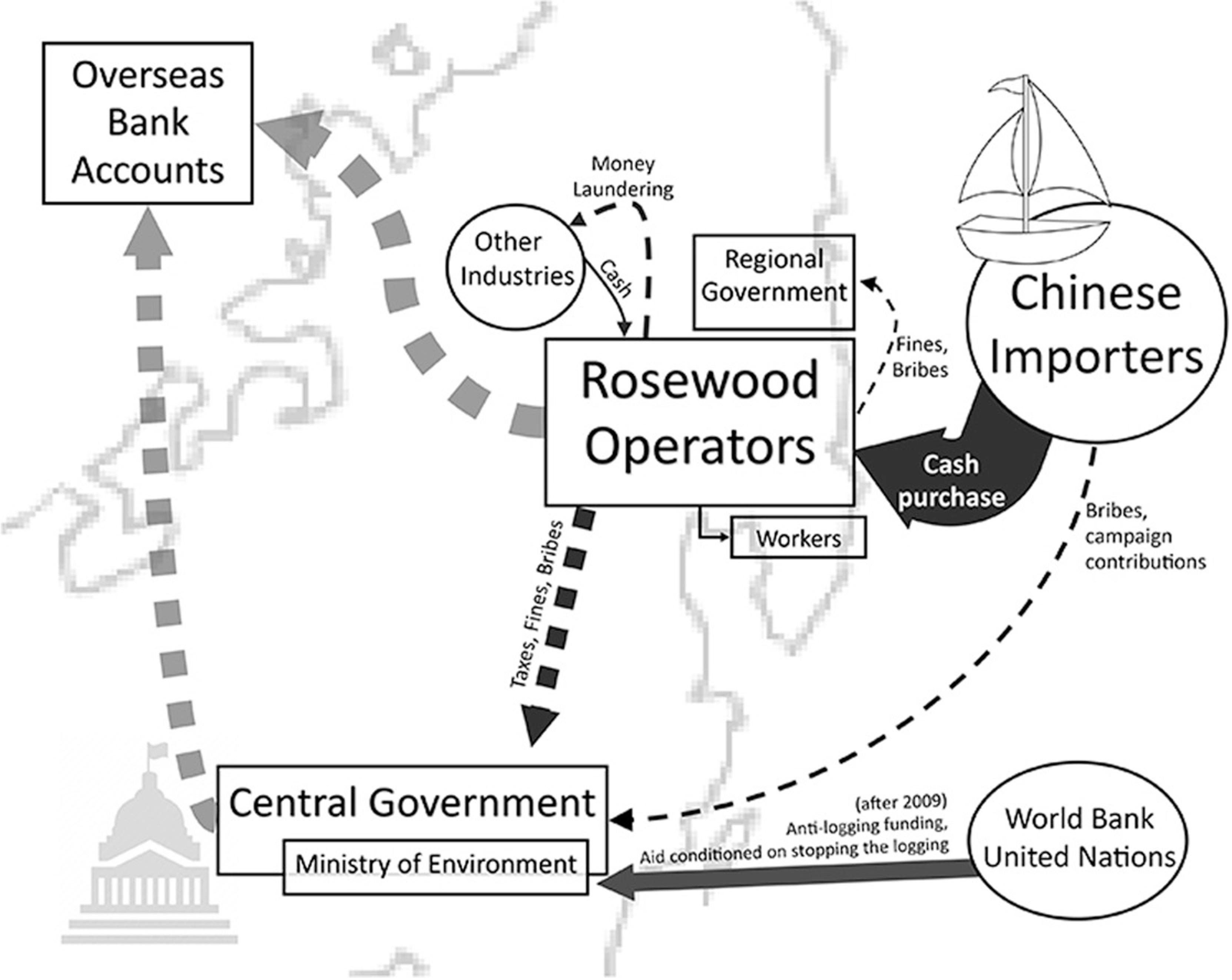

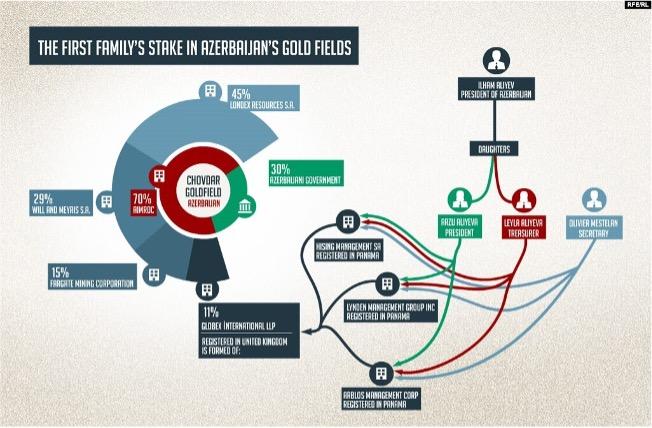

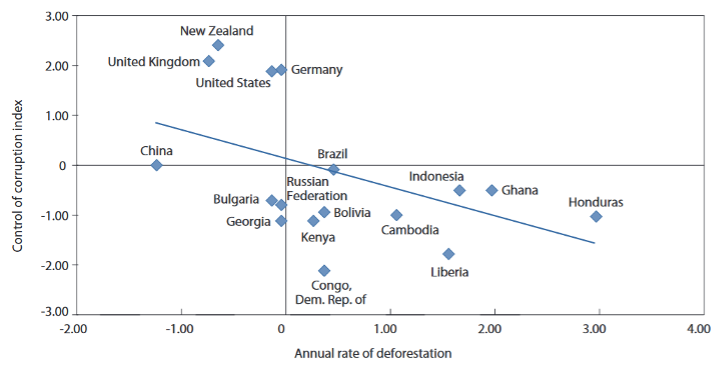

|